Greenboard Reviews, Pricing, and Alternatives (November 2025)

Compare Greenboard compliance software features, pricing, and top alternatives for financial firms. See why Luthor offers 7× faster marketing approvals November 2025.

Compliance software shopping typically involves sitting through demos and trying to determine whether you'll actually use half the features you're quoted for. We created this Greenboard alternatives guide to show you what the tool includes and how it compares to other options. If your team needs fast marketing approvals and more than just vendor management modules, you'll want to see what else is out there.

TLDR:

-

Greenboard bundles marketing review with vendor management and employee attestations, which can mean teams focused mainly on marketing pay for modules they rely on less often

-

Luthor accelerates marketing approvals 7× faster with AI-powered review and fractional CCO support for financial firms

-

Greenboard requires custom enterprise pricing with no transparent rates

-

Luthor integrates directly with content tools and monitors websites, emails, and social media in real time.

What Is Greenboard and How Does It Work?

Greenboard is web-based compliance software for SEC and FINRA-regulated financial firms, particularly registered investment advisors. The software consolidates communications archiving, code of ethics attestations, forensic testing, risk assessments, marketing material reviews, and vendor management into one interface.

Greenboard raised seed funding in 2024 to build this unified approach for firms that typically rely on consultants or large in-house compliance teams. The software aggregates client data and compliance activities into one system, monitoring communications, tracking employee attestations, managing vendor due diligence, and reviewing marketing materials from the same environment.

The AI scans for potential violations or risk signals across these compliance areas, flagging items that need attention. Compliance officers can then review flagged issues, approve materials, and maintain audit trails without needing to switch between different tools.

Greenboard Features

Greenboard organizes features across six compliance categories:

-

Firm compliance

-

Employee compliance

-

Third-party vendor compliance

-

Marketing compliance

-

Communications archiving and supervision

-

Books and records management

Each area is supported by automated workflows, AI assistance, and centralized record-keeping.

Communications Archiving and Supervision

The archiving module captures email, text messages, social media, and collaboration tools in a searchable archive. AI scans these communications for regulatory violations, insider trading patterns, or prohibited language, then flags exceptions for review. Compliance teams can create custom lexicons and rules to align with their firm's specific policies.

Marketing Reviews and Approvals

Marketing compliance includes submission workflows where advisors upload content for approval. The system checks materials against SEC advertising rules and firm guidelines, then stores approved materials with version history and audit trails.

Employee Attestations and Code of Ethics

Greenboard automates annual and quarterly attestations for codes of ethics, personal trading disclosures, and outside business activities. Employees complete questionnaires directly in the system, and compliance officers receive automated reminders when deadlines approach or certifications lapse.

Vendor Due Diligence and Risk Assessments

The vendor management module tracks third-party relationships, due diligence questionnaires, contract renewals, and risk ratings. Compliance teams can run forensic tests across their vendor portfolio and maintain centralized documentation for exam readiness.

Greenboard holds SOC 2 Type II certification, which validates that the system meets security and availability standards for handling sensitive compliance data.

Greenboard Key Limitations and Gaps

Greenboard bundles communications archiving, vendor management, employee attestations, and marketing reviews into a single system. Teams focused solely on marketing oversight end up paying for modules they don't need while dealing with unrelated compliance categories.

As an all-in-one solution spanning multiple compliance areas, Greenboard typically requires configuration of workflows, permissions, and training across teams, which can add setup time for firms that only need faster marketing approvals.

Pricing and Cost Justification

Greenboard uses custom enterprise pricing with no transparent rates. Evaluation requires scheduling demos and negotiating quotes with sales. For teams where marketing compliance is the primary need, defending enterprise costs becomes difficult when only a fraction of features get used.

Built for Breadth, Not Marketing Speed

Greenboard’s strength is breadth: it unifies archiving, employee, firm, third-party, and marketing compliance under one OS.

Its marketing module touts configurable workflows, logs, and exam-ready reporting versus AI-assisted content drafting or collaborative editing. High-volume marketing teams that want suggested language and instant rewrite options may find they still need separate tooling for content creation.

Best Greenboard Alternative in November 2025

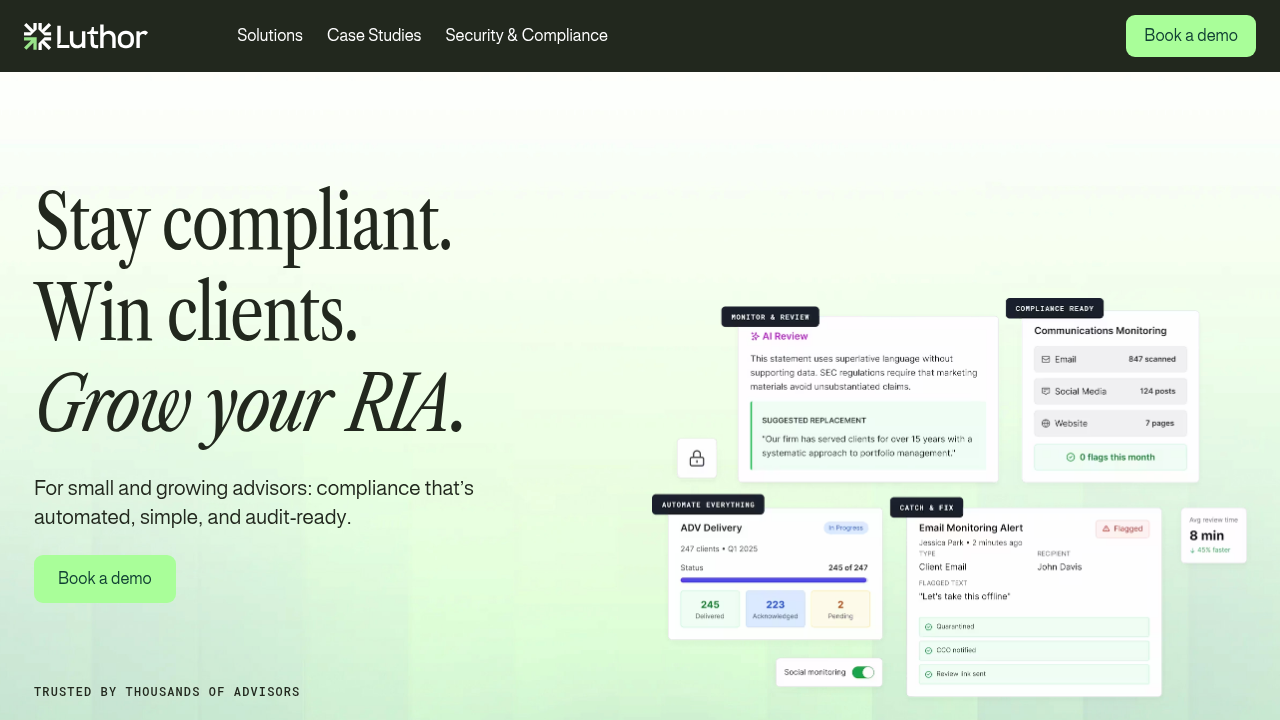

Luthor provides an AI-powered marketing review built for financial services firms that need compliance without enterprise overhead. The system automates content review, disclosure checks, and regulatory filings through a hybrid approach that pairs AI with fractional Chief Compliance Officers for more complex judgment calls.

Speed and Real-Time Monitoring

Clients approve content up to 7× faster than manual processes, moving from roughly six marketing pieces per month to 45+ while maintaining compliance. Real-time monitoring scans websites, emails, social media, and paid ads as content goes live. Instant risk alerts flag non-compliant language and suggest fixes before publication, eliminating batch review delays and multi-step approval queues.

Target Market and Integration

Luthor serves registered investment advisors, broker-dealers, wealth management firms, and fintech startups that need better compliance. The system integrates with existing content tools, scanning materials in the background without requiring teams to switch applications. Instead of enterprise licensing that bundles vendor management, employee attestations, and forensic testing modules, Luthor delivers targeted marketing compliance at a fraction of full-time compliance staff costs.

The system is trusted by SEC- and FINRA-regulated firms and maintains SEC Rule 17a-4 WORM-compliant archiving. The AI comes pre-configured with SEC and FINRA advertising rules.

| Feature | Greenboard | Luthor |

|---|---|---|

| Marketing Review Module | Included as one module within a broader enterprise compliance suite (attestations, vendor management, archiving) | Purpose-built AI marketing review engine for RIAs, BDs, and fintech marketing teams |

| AI/Automation | AI scanning across communications + compliance areas; limited marketing-specific automation | SEC/FINRA-trained AI engine with instant risk alerts, suggested fixes, and fractional CCO oversight |

| Multi-Channel Coverage | Broad compliance coverage; marketing review is only one component | Full coverage: websites, email, social, ads, advisor pages, PDFs, decks |

| Pricing Transparency | No public pricing; enterprise quotes only | Transparent, mid-market pricing through sales |

| Best Fit | Firms needing an all-in-one compliance solution across vendors, employees, communications, and firm compliance | Firms needing faster marketing approvals without paying for enterprise modules they won’t use |

Other Greenboard Alternatives

Additional options include SmartRIA, ACA ComplianceAlpha, Smarsh, COMPLY (formerly RIA in a Box), StarCompliance, and Archive Intel. Each serves different firm sizes and compliance needs, though most lack marketing-specific automation that financial advisors require for growing their practices while meeting regulatory obligations.

Final thoughts on compliance software options

Greenboard covers communications, vendors, and employee compliance in one system. If you need that full range, it makes sense. For firms where marketing review is the priority, paying for unused modules adds cost without value. Greenboard alternatives like Luthor focus on getting your content approved faster with AI scanning and fractional CCO support. You spend less time managing workflows and more time publishing compliant content.

FAQ

What is Greenboard best suited for?

Greenboard works best for firms that need compliance management across communications archiving, vendor due diligence, employee attestations, and marketing reviews in one system. If your primary need is marketing compliance alone, you'll pay for modules you won't use.

How does Greenboard's pricing model work?

Greenboard uses custom enterprise pricing with no published rates. Any trial or pilot options require a conversation with their sales team.

What's the main difference between Greenboard and Luthor?

Greenboard bundles multiple compliance functions (vendor management, employee attestations, communications archiving) into an enterprise system, while Luthor focuses on marketing compliance with AI-powered review and fractional CCO support. Luthor clients approve content up to 7× faster without paying for unrelated compliance modules.

When should I consider a Greenboard alternative?

Consider alternatives if you're primarily focused on marketing compliance speed, need transparent pricing, or want to avoid the time-consuming setup required for features you won't use. Marketing teams publishing frequently benefit more from specialized tools that accelerate approvals instead of broad compliance suites.