COMPLY Reviews, Pricing, and Alternatives (November 2025)

COMPLY reviews, pricing, and alternatives for RIAs in November 2025. Compare features, costs, and why investment advisors choose automated compliance solutions.

You're comparing COMPLY alternatives because you know there has to be a better way to handle compliance than manually reviewing every piece of content your team creates. The old approach of submitting everything for human review works, but it's slow and it doesn't scale when you're trying to grow your practice. Let's look at what COMPLY offers and how other tools handle the same problems differently.

TLDR:

- COMPLY offers compliance templates and calendars but requires manual content reviews

- Pricing isn't published online; firms must complete sales calls to learn costs

- Luthor automates SEC/FINRA rule-checking with AI and speeds approvals 7× faster

- Firms using Luthor scale from 64% accuracy to up to 96% accuracy based on internal benchmarks

What is COMPLY and How Does It Work?

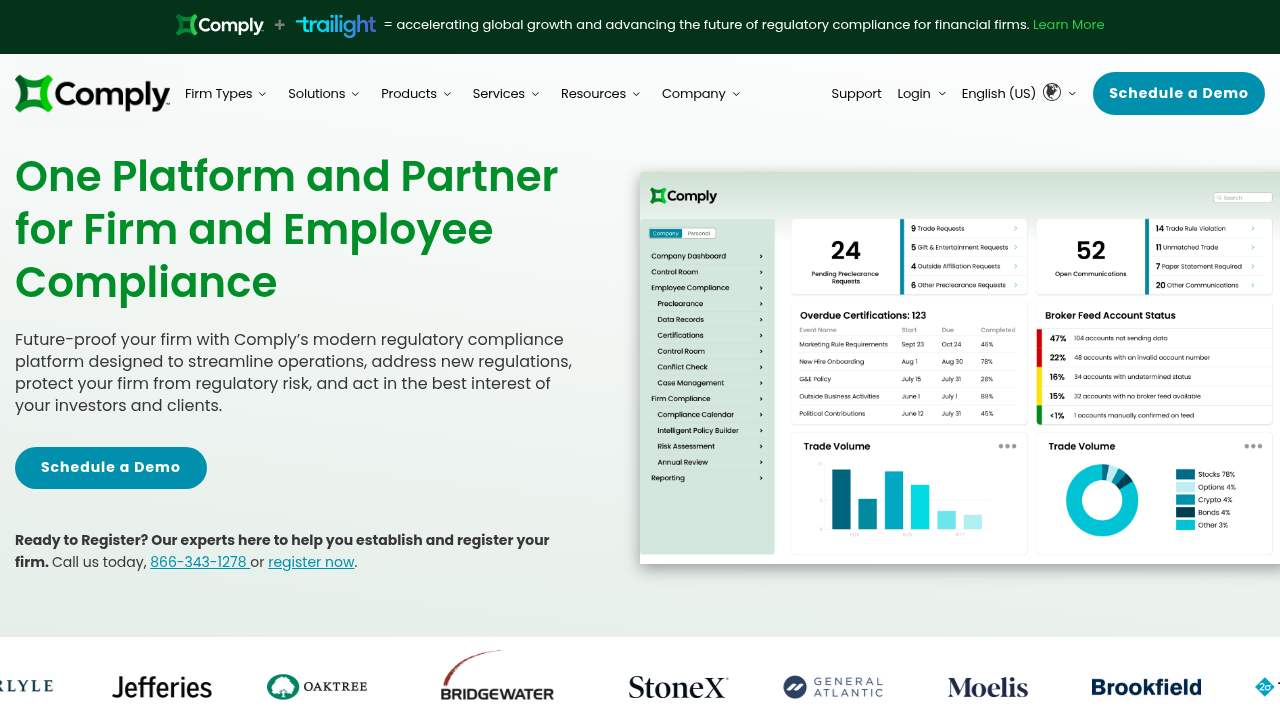

COMPLY is a compliance management company that acquired RIA in a Box in 2021, combining regulatory expertise with cloud-based software. The service helps investment advisors meet regulatory obligations through a mix of software tools, consulting services, and educational resources.

The company serves over 2,000 registered investment advisor firms across the United States. Its core audience includes small to mid-sized RIAs, broker-dealers, and wealth management firms that need structured compliance oversight without maintaining large in-house compliance teams.

How COMPLY Works

COMPLY provides a library of pre-built compliance policies and procedures tailored to the investment advisory industry. Firms can customize these templates, then track implementation and updates through the software. The system includes calendars that alert users to filing deadlines and regulatory events like Form ADV updates and annual reviews.

The service also includes consulting support and educational resources. Firms can access webinars, training materials, and direct support from compliance professionals when questions arise.

COMPLY Features

COMPLY provides tools for RIAs to manage regulatory obligations through documentation, record-keeping, and procedural oversight.

Compliance Calendars and Scheduling

The software generates customized compliance schedules based on each firm's registration status. These calendars track filing deadlines, annual review dates, and routine compliance tasks, with notifications when action items are due to help prevent missed Form ADV updates or required internal reviews.

Document Management and Archiving

COMPLY stores compliance documentation and activities in a centralized system. Users can filter and export records during regulatory examinations. The archiving functionality captures client-facing communications from email, social media, and websites to meet SEC Rule 204-2 requirements, though this often requires manual uploads or separate integrations.

Marketing and Advertising Review

The marketing review workflow allows compliance officers to evaluate advertising materials against SEC marketing rules and state regulations. Firms submit content for approval, where it can be reviewed, annotated, and either approved or sent back for revisions. This process relies on human reviewers to identify potential violations rather than automated rule-checking.

Additional Features

- CCO management tools for tracking employee attestations, external business activities, and advertising approval workflows

- State registration threshold alerts that notify firms when client household counts approach levels requiring additional filings

- Form ADV preparation that pre-populates fields using stored firm data and guides users through annual updates

- Vendor management documentation to track third-party tech providers and assess associated risks

- Continuing education administration as an approved CE provider, with course libraries and employee credit tracking

COMPLY Key Limitations and Gaps

COMPLY uses fixed compliance workflows that require firms to adjust their internal processes to match the software's structure. Teams with established procedures that work well may need to abandon them or run duplicate systems.

Opaque Pricing

COMPLY doesn't list pricing online. Firms must schedule demos and complete sales conversations before learning actual costs, making budget planning and cost comparisons difficult upfront.

Check-the-Box Approach

The system focuses on documentation and calendar tracking rather than proactive risk detection. With the SEC finalizing record numbers of new rulings, a procedural-only approach leaves gaps when emerging compliance issues fall outside standard checklists.

Limited Automation

Marketing review depends on human reviewers to manually evaluate content against regulations. Without automated rule-checking or real-time monitoring, approval bottlenecks slow marketing teams and increase oversight error risk.

Archiving often requires manual uploads or separate integrations to capture communications across channels. Frequent publishing across social media, email, and web updates turns complete recordkeeping into time-consuming administrative work.

Best COMPLY Alternative

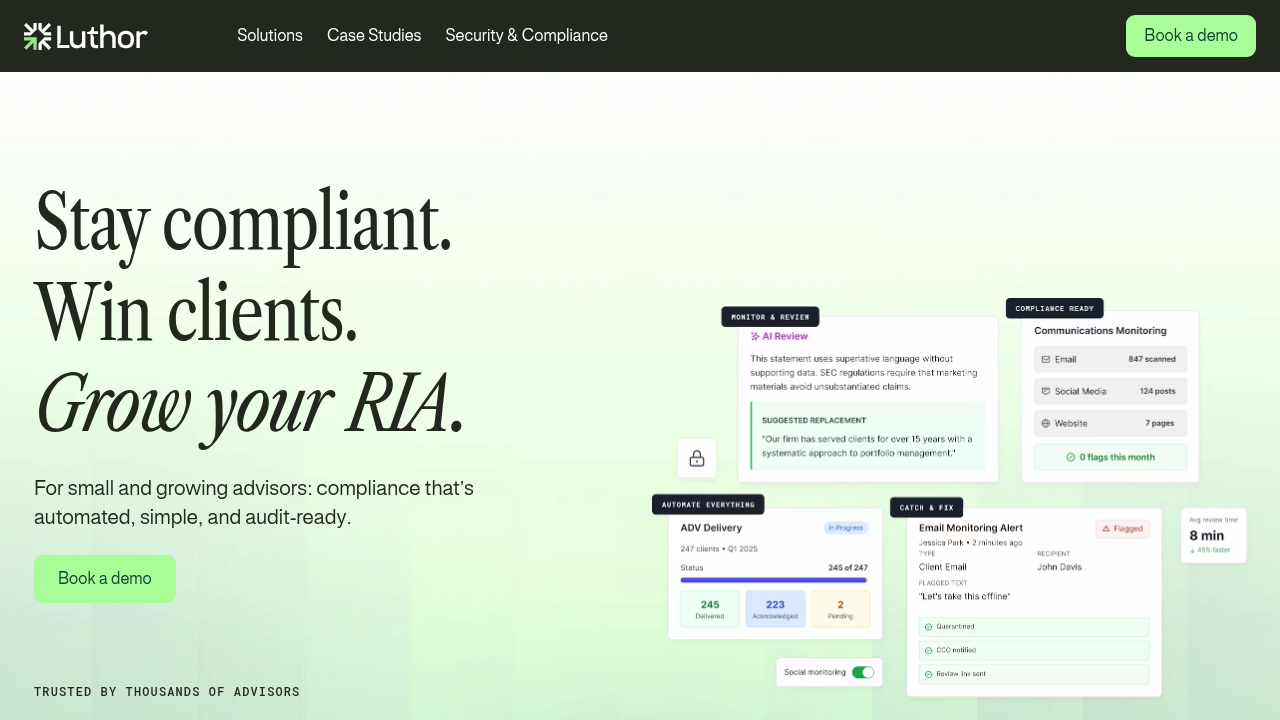

Luthor takes a different approach than COMPLY by using AI to monitor content in real time across websites, emails, social media, and ads. The system flags potential SEC and FINRA violations as they happen and suggests specific fixes, rather than requiring manual submission and human review for each piece.

How Luthor Differs

The system scans continuously across channels, checking content against regulatory rules automatically. When complex questions or high-risk materials need review, fractional Chief Compliance Officers are available. Investment advisers increasingly seek tech that supports compliance work without replacing human oversight entirely.

Luthor integrates with existing tools so compliance checks happen in the background. Firms typically scale from around 6 marketing pieces per month to 45+ without adding compliance headcount. The system is trusted by firms managing over $1.2 billion in AUM and maintains SEC Rule 17a-4 compliant archiving standards.

| Feature | COMPLY | Luthor |

|---|---|---|

| Content monitoring | Manual submission required | Automated real-time scanning |

| Rule checking | Human reviewer evaluation | AI engine trained on SEC/FINRA rules |

| Approval speed | Days to weeks | Minutes to hours |

| Channel coverage | Requires separate integrations | Multi-channel monitoring included |

| Expert support | Consulting add-on | Fractional CCO access included |

Other COMPLY Alternatives

Additional options include SmartRIA, ACA ComplianceAlpha, Smarsh, VComply, StarCompliance, and Archive Intel. Each serves different firm sizes and compliance needs, though most lack marketing-specific automation that financial advisors require for growing their practices while meeting regulatory obligations.

Final thoughts on COMPLY compliance management

COMPLY handles the basics well with calendars, templates, and consulting access. Where it falls short is marketing review speed and automation. If you're looking at COMPLY alternatives, consider how much content you publish each month. Luthor's AI checks everything in real time across all your channels, so you can scale without hiring more compliance people.

FAQ

How much does COMPLY typically cost?

COMPLY doesn't publish pricing on its website, requiring firms to schedule demos and complete sales conversations before learning actual costs. This makes upfront budget planning and comparison shopping difficult for RIAs evaluating compliance solutions.

What's the main difference between manual compliance review and automated monitoring?

Manual review requires submitting each piece of content for human evaluation, which can take days or weeks and creates approval bottlenecks. Automated monitoring scans content in real time across all channels, flags potential violations instantly, and suggests specific fixes before publication.

When should I consider switching from my current compliance software?

If your marketing team is waiting days for content approvals, you're spending hours on manual uploads for recordkeeping, or you're limited to 15-20 marketing pieces per month due to compliance bottlenecks, it's time to evaluate alternatives that offer real-time monitoring and faster approval cycles.

Can compliance software integrate with my existing marketing tools?

Integration capabilities vary widely by provider. Some solutions require manual uploads or separate integrations for each channel, while others connect directly to your CMS, email platforms, and social media accounts to scan content automatically in your existing workflow without switching applications.

What does SEC Rule 17a-4 compliant archiving mean for my firm?

SEC Rule 17a-4 requires tamper-proof storage of communications and records in a WORM (write once, read many) format. Compliant archiving means your stored materials meet regulatory standards for retention and retrieval during examinations, protecting your firm from recordkeeping violations.