Top Real-Time Marketing Compliance Monitoring Tools for RIAs in December 2025

Compare top real-time compliance monitoring tools for RIAs in Dec. 2025. AI-powered tools that scan websites, social media, & emails for SEC/FINRA violations.

Adviser marketing now moves faster than most compliance teams can review it, creating a widening gap between what RIAs publish and what their CCOs have time to assess. Content hits websites, social channels, and emails in seconds, while manual workflows still operate on weekly or monthly review cycles. That delay is exactly where exam findings, outdated disclosures, and missed rule violations originate. A real-time compliance monitoring system can bridge this gap by watching live content as it’s published and flagging issues the moment they appear, but understanding how continuous monitoring works, and why it matters, starts with knowing how far today’s tools have evolved.

TLDR:

- Real-time monitoring catches compliance violations as content goes live, not weeks later.

- AI-powered tools scan websites, social posts, and marketing emails, depending on integration and configuration.

- Some solutions combine automated content review with access to former experienced compliance professionals, including former CCOs and regulatory examiners.

- Most tools only handle pre-approval workflows without monitoring published content.

- Real-time AI compliance systems can review marketing across all channels as it’s created and published.

What Is Real-Time Compliance Monitoring for RIAs?

Real-time compliance monitoring is the continuous, automated oversight of marketing materials and client communications as they're created and published. These tools scan websites, social posts, emails, and other content the moment they go live or while they're being drafted.

Traditional compliance reviews happen in batches. A CCO manually reads through a backlog of materials every few weeks. Real-time monitoring changes that model by watching your marketing footprint constantly and flagging potential violations of the SEC Marketing Rule (Advisers Act Rule 206(4)-1) and applicable state advertising regulations as soon as they appear.

This matters because adviser marketing moves fast. A social post goes live in seconds. A website update publishes instantly. Without continuous monitoring, non-compliant content can circulate for weeks before anyone catches it, creating exam risk and enforcement exposure.

How We Ranked Real-Time Compliance Monitoring Tools

We tested each tool against criteria that matter when preventing exam findings and accelerating approvals.

Our ranking used seven factors:

- AI-powered review that identifies potential compliance risks and regulatory issues before content reaches human reviewers

- Pre-publication and post-publication monitoring to catch issues during drafting and after materials go live

- Multi-channel coverage across websites, social media, email, video, and audio content

- Regulatory risk detection for violation patterns like unsupported performance claims, missing disclosures, testimonials, and guarantees

- Audit trail and recordkeeping that meet SEC investment adviser recordkeeping requirements (including Advisers Act Rule 204-2), as applicable

- Workflow integration with existing marketing tools and approval processes

- Human compliance expertise for complex judgment calls

Top-scoring tools combined strong automation with flexible monitoring and expert support.

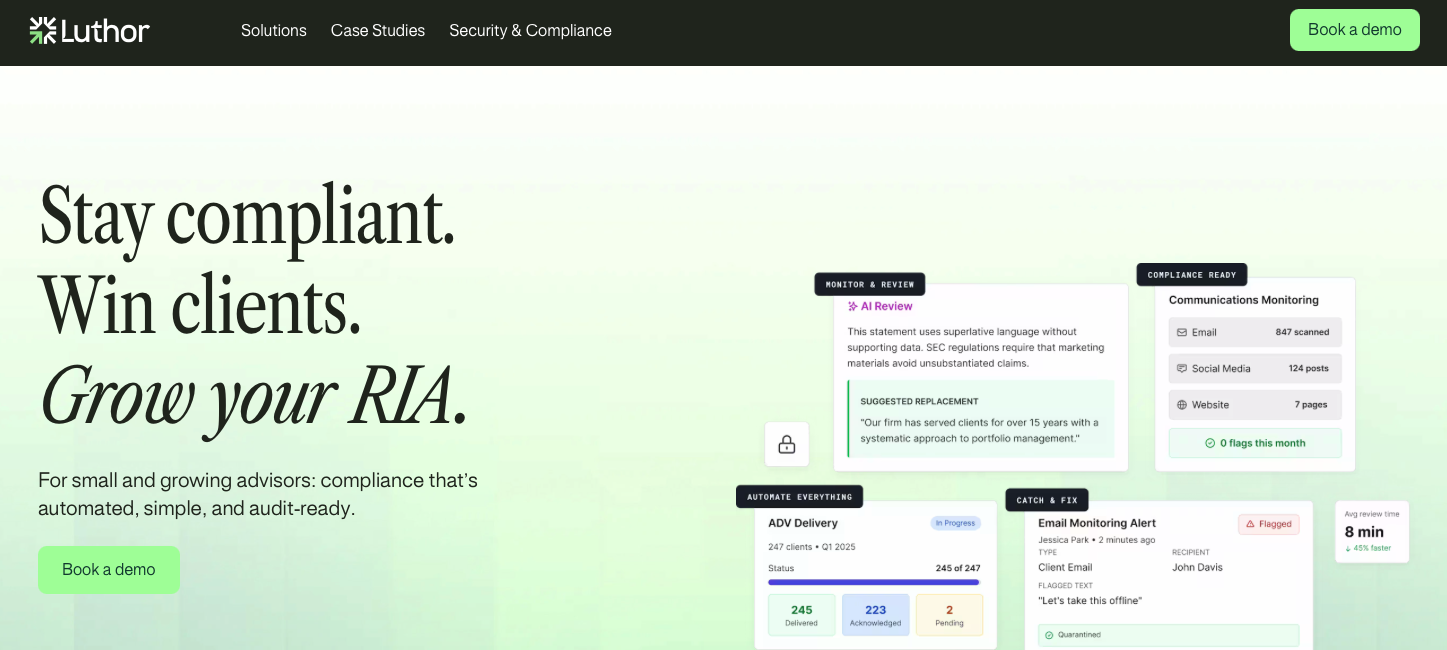

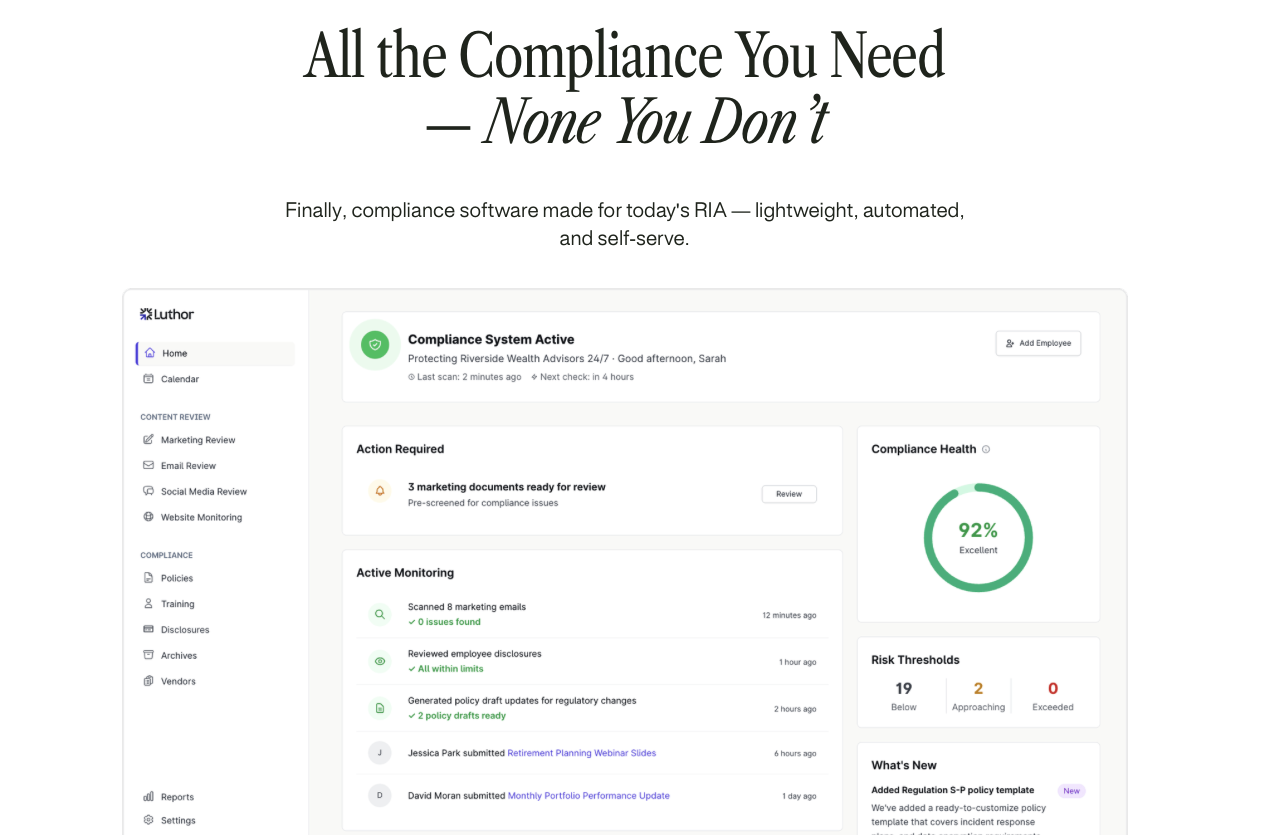

Luthor

Luthor automates compliance checks across all marketing channels and provides direct access to experienced compliance professionals. The system monitors live content, flags violations, and proposes compliant rewrites based on the SEC Marketing Rule (Advisers Act Rule 206(4)-1) and applicable state advertising regulations.

What Luthor Offers

- AI review engine designed using datasets and guidance aligned with the SEC Marketing Rule (Advisers Act Rule 206(4)-1) and applicable state advertising regulations, with custom policy encoding for firm-specific standards

- Real-time monitoring of websites, social feeds, email campaigns, and adviser communications with instant violation alerts

- Multi-channel content review covering text, video, audio, and multi-language materials

- Automated audit trails and tamper-resistant archiving designed to support SEC recordkeeping obligations for investment advisers

- Hybrid model pairing AI automation with on-demand support from experienced compliance professionals, including former CCOs and regulatory examiners

The AI was trained using proprietary datasets built by compliance experts. The system handles both pre-publication review and post-publication monitoring, keeping content compliant from draft through its entire lifecycle. When complex judgment calls arise, you get immediate access to human advisers who understand regulatory nuance and exam strategy.

Kadince

Kadince is a workflow management tool for banks and credit unions that digitizes marketing approval processes and organizes compliance documentation.

What They Offer

- Digital project submission and approval tracking with email notifications

- Searchable archive of marketing materials organized by department and product

- Customizable approval workflows with sequential reviewer assignments

- Audit preparation features including temporary auditor login access

Kadince works for community banks and credit unions replacing manual, binder-based approval processes with basic digital workflow management. The system handles sequential approvals and centralizes marketing documentation but offers limited automation.

The tool lacks AI-powered content analysis to detect compliance risks automatically. Reviewers must manually identify issues with testimonials, performance claims, and disclosure requirements. Kadince does not support real-time monitoring of live websites or social media and provides no access to external compliance expertise for complex marketing questions.

IntelligenceBank

IntelligenceBank is a digital asset management and marketing operations solution that includes compliance workflow features for brand and content governance.

What They Offer

- Centralized asset library with metadata tagging and version control

- Customizable approval workflows and brand guideline enforcement

- AI content scanning to flag trigger words and missing disclaimers

- Audit trail tracking for user actions and asset modifications

IntelligenceBank works well for large enterprises managing extensive digital asset libraries across multiple brands or regions. The system focuses on centralized content management and provides basic compliance rule checking as part of broader marketing operations.

The tool is built as a generalist DAM system instead of being purpose-built for financial services compliance. It lacks deep knowledge of SEC Marketing Rule nuances, FINRA advertising standards, and RIA-specific disclosure requirements. You won't get access to compliance professionals for interpretation of complex regulatory scenarios. Pricing typically exceeds mid-market RIA budgets.

Saifr

Saifr is an AI compliance software from Fidelity Labs that detects regulatory risks in marketing content for financial institutions.

What They Offer

- AI models trained on financial advertising rules to identify non-compliant language

- Suggested alternative language for flagged compliance issues

- Integration with Microsoft Azure AI model catalog for enterprise deployment

- Compliance risk scoring with explanations for detected issues

Saifr works best for large financial institutions already using Microsoft Azure infrastructure. You need internal compliance teams to manage implementation and interpretation.

The tool requires technical integration and configuration instead of offering a turnkey solution. It lacks built-in workflow management and approval tracking. Saifr does not monitor published content after initial review. You get no access to external compliance consultants or CCO expertise for judgment calls on borderline content.

Red Oak

Red Oak is an advertising review workflow software for broker-dealers and investment advisers with recently added AI capabilities.

What They Offer

- Configurable approval workflows with role-based review assignments

- Lexicon scanning to identify prohibited words and phrases automatically

- Centralized disclosure library management with automated insertion

- SEC Rule 17a-4 compliant recordkeeping and audit trail documentation

Red Oak works for broker-dealers and larger advisory firms with compliance departments that need workflow orchestration and disclosure management alongside consulting services for advertising review outsourcing.

The AI review module is a relatively recent addition and less mature than purpose-built AI compliance platforms. Red Oak does not provide continuous monitoring of live digital content after approval. The system requires configuration and rule-building instead of offering out-of-the-box intelligence on current SEC Marketing Rule requirements.

Red Oak delivers solid workflow automation for firms comfortable building custom rule sets and managing ongoing configuration.

Why Luthor Is the Best Real-Time Compliance Monitoring Tool for RIAs

Mid-sized RIAs face growing compliance gaps as marketing channels multiply faster than internal resources can scale. The typical firm runs high marketing volume through limited compliance staff while facing increased exam pressure.

Social media creates ongoing compliance requirements that demand real-time oversight, not quarterly batch reviews. Content goes live across channels while most tools only handle pre-approval workflows.

Generic AI approaches to compliance miss regulatory nuance. Models trained on general datasets can't reliably catch SEC Marketing Rule edge cases that matter during exams.

Real-time compliance monitoring requires three components: AI that detects violations accurately, continuous monitoring across all channels, and access to expert judgment when edge cases appear. Most vendors deliver one or two, forcing you to patch together partial solutions.

FAQs

How does real-time monitoring differ from traditional compliance reviews?

Traditional reviews happen in batches every few weeks, with a CCO manually reading through backlogs of materials. Real-time monitoring watches your marketing footprint continuously, flagging potential SEC Marketing Rule (Advisers Act Rule 206(4)-1) violations the moment content goes live or during drafting.

What types of content can real-time compliance tools monitor?

The most capable tools monitor websites, social media posts, email campaigns, adviser communications, video content, and audio materials across all channels. Basic tools only handle pre-approval workflows for text-based materials and miss post-publication changes.

Do I still need human compliance expertise if I use AI monitoring?

Yes. AI handles high-volume pattern detection and routine checks, but human experts remain necessary for edge cases, detailed regulatory interpretations, novel marketing campaigns, and exam strategy decisions that require judgment calls.

Final thoughts on compliance monitoring for investment advisers

Real-time compliance monitoring tools need to keep pace with the speed at which advisers publish content, because gaps measured in weeks allow non-compliant materials to circulate and create avoidable exam exposure. Real-time monitoring reduces that window by watching websites, social channels, and outbound communications as they change, flagging violations based on current SEC Marketing Rule standards (and applicable state advertising regulations) instead of relying on delayed batch reviews. Firms gain faster approvals, clearer visibility into risks, and better support when detailed questions arise. Solutions like Luthor, which combine continuous oversight with both automated checks and access to experienced compliance professionals, help advisers stay aligned with regulatory expectations while keeping day-to-day marketing workflows running smoothly.