Top Marketing Approval Workflow Software for Broker-Dealers in December 2025

Compare top marketing approval workflow software for broker-dealers in December 2025. AI-powered FINRA 2210 compliance tools with audit trails and monitoring.

Managing FINRA 2210 approvals across dozens of advisers, fast-moving campaigns, and multiple publishing channels often leaves compliance teams reacting instead of reviewing with confidence. Email threads lose history, spreadsheets fall apart under volume, and manual checks miss violations that surface later during exams. Broker-dealers increasingly rely on marketing approval workflow software that can review content before publication, track approvals automatically, and retain records examiners expect. We compared the tools broker-dealers actually use to see which ones keep pace with modern adviser marketing and which fall short.

TLDR:

- Broker-dealers need software that automates FINRA 2210 compliance checks and creates audit trails.

- AI-powered tools flag violations like missing disclosures before publication, reducing exam risk.

- Post-publication monitoring catches unapproved edits on live adviser pages and social feeds.

- Advanced marketing compliance systems pair automated content screening with access to former regulators for complex edge cases.

- Centralized approval workflows replace email and spreadsheets while maintaining consistent standards across advisers and channels.

What Is Marketing Approval Workflow Software for Broker-Dealers?

Marketing approval workflow software manages review, approval, and archiving of broker-dealer communications before publication. These systems automate compliance checks against FINRA Rule 2210, which sets standards for broker-dealer communications with the public and requires registered principal approval of most retail communications prior to first use, with supervisory review requirements that vary for institutional communications and correspondence.

The software replaces email chains and spreadsheets. It tracks who reviewed content, when approvals were granted, what changes were requested, and whether required disclosures appear in final versions. Most solutions flag common violations like exaggerated claims, missing risk disclosures, or prohibited performance representations.

FINRA Rule 2210 requires broker-dealers to retain copies of advertisements and sales literature, including evidence of principal review and first-use dates, while SEC 17a-4 governs how those records must be preserved using compliant electronic recordkeeping controls (for example, WORM storage or the SEC’s audit-trail alternative, depending on the firm’s approach). Marketing approval workflow software creates audit trails automatically and stores records in tamper-evident archives.

Manual review processes fail when managing adviser social posts, email campaigns, web pages, and PDF brochures across multiple channels. Firms publishing more than a few marketing pieces monthly need automated workflow software.

How We Assessed Marketing Approval Workflow Software

We assessed each solution against six criteria:

- FINRA 2210 compliance capabilities: Does the system identify prohibited claims, flag missing disclosures, and enforce principal review requirements for retail communications?

- Workflow automation: Can the software route content to appropriate reviewers, track approval status, and manage revision cycles without manual coordination?

- Audit trail quality: Does it capture every review decision, editor change, and approval timestamp in a format that satisfies FINRA exam requirements?

- Multi-channel coverage: Can it handle web content, email, social media, PDFs, and other asset types through a single review process?

- AI-powered detection: Does it use automation to pre-screen content for common violations before human review?

- Integration capability: Will it connect to existing marketing tools and workflows without requiring teams to abandon current systems?

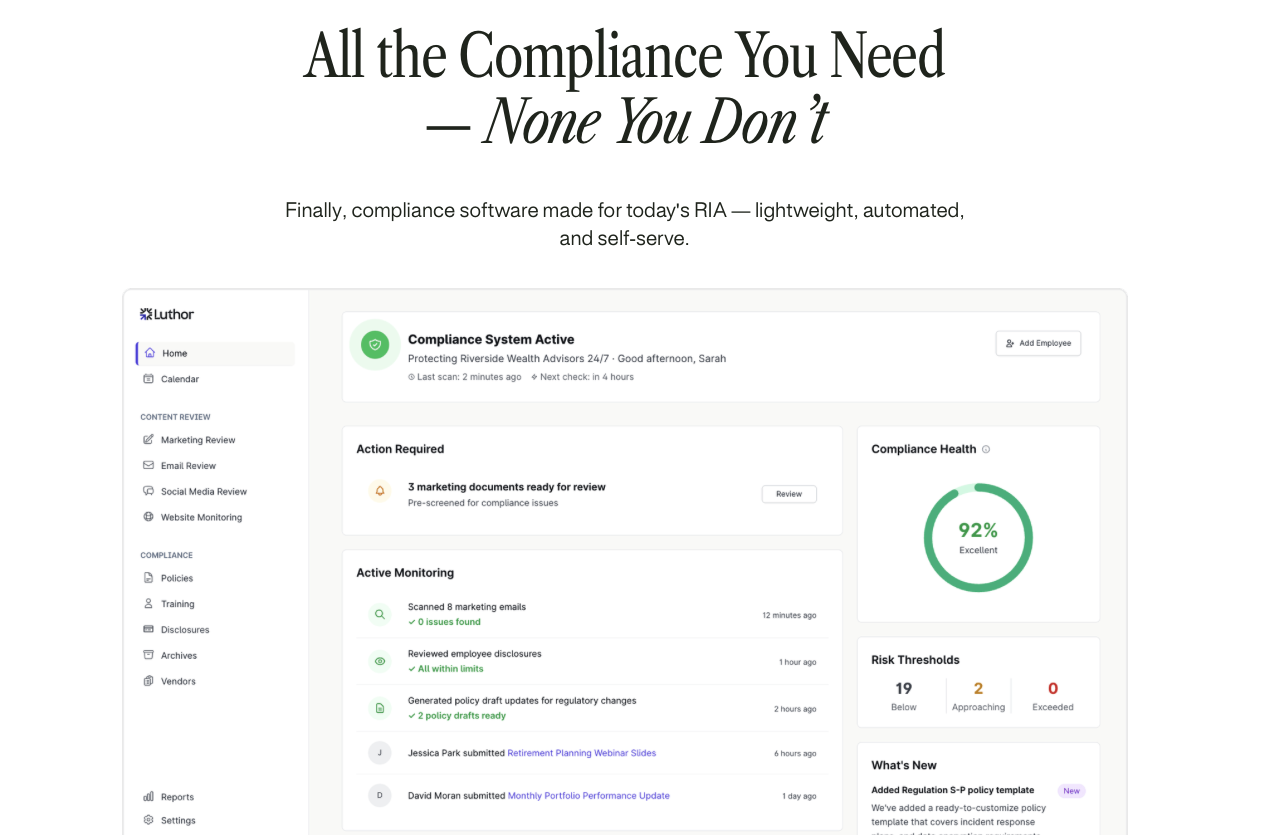

Luthor

Luthor pairs AI-powered content screening with on-demand compliance experts. The AI review engine flags FINRA 2210 violations across web pages, emails, PDFs, social posts, video, and audio before materials reach human reviewers. This hybrid approach automates repetitive pattern detection while reserving expert judgment for detailed calls.

The system scans for performance claims, testimonials, guarantees, superlatives, and missing disclosures. When it detects a potential issue, it focuses on the language, explains the underlying rule, and suggests compliant alternatives. Custom rules let you encode firm-specific policies on top of baseline regulatory requirements.

Real-time monitoring tracks live websites and adviser pages for unapproved edits after publication. Content that drifts out of compliance automatically routes back through review. All approvals, edits, and flags are retained in an immutable audit trail designed to support SEC and FINRA examination and record-retention requirements.

The AI models are trained on compliance-reviewed datasets developed with input from experienced compliance professionals. When complex campaigns require deeper analysis, you can escalate directly to former regulators and CCOs who understand exam strategy and edge-case interpretations.

Kadince

Kadince is a web-based marketing compliance tool built for banks and credit unions. It includes workflow approval features for financial institutions.

What They Offer

- Browser-based project submission with automated email notifications and approval routing for marketing materials

- Archiving and logging of changes, notes, and approvals with attachment support for tearsheets and ROI tracking

- Automated workflow assignment for spelling, grammar, management, and compliance reviews across multiple file formats

- CRA tracking, community involvement management, and complaint management modules

Kadince works for community banks and credit unions that need basic workflow automation for marketing approvals alongside CRA and community involvement tracking.

The limitation: no AI-powered risk detection or intelligent content analysis for FINRA 2210 or SEC Marketing Rule requirements. The tool relies on manual human review without automated flagging of regulatory violations. This can lead to slower turnaround times and increased compliance risk for broker-dealers managing high volumes of adviser marketing content across multiple channels.

IntelligenceBank

IntelligenceBank is a digital asset management and marketing operations system with brand governance and compliance workflow capabilities built for enterprise marketing teams.

What They Offer

- Digital asset management with version control, metadata tagging, and centralized repository for brand assets and marketing materials

- Customizable workflow approvals with role-based permissions, in-line annotations, and approval tracking for marketing projects

- Marketing compliance module (acquired Red Marker) with AI content review focused on UK and US retail banking regulations

IntelligenceBank works for large enterprises with complex brand management needs across multiple markets that need a DAM and brand portal system where financial compliance is one component among broader marketing operations.

The limitation: IntelligenceBank’s compliance capabilities are generalized across financial services and brand governance use cases, instead of being purpose-built for broker-dealer–specific FINRA Rule 2210 workflows and adviser-level content monitoring. IntelligenceBank is built primarily as a DAM with compliance as an add-on feature. It is not typically deployed as a broker-dealer–purpose-built FINRA 2210 tool for continuous adviser-level monitoring across live sites and social profiles, and capabilities can vary by module and configuration.

Saifr

Saifr is a RegTech solution from Fidelity Labs that uses AI to review financial services marketing communications and monitor electronic communications.

What They Offer

- SaifrReview workflow tool with AI models trained on compliance-reviewed data to flag non-compliant language in written materials, social media, audio, and video

- Risk scoring and disclosure detection during document creation with in-line collaboration between marketing and compliance teams

- SaifrScan for monitoring live websites and published content, with compliance models covering FINRA 2210, SEC 482, and SEC Marketing Rule

- Integration with Microsoft Azure for enterprise deployment

Saifr works for large financial institutions with enterprise tech requirements that already use Microsoft Azure infrastructure and need a vendor with Fidelity pedigree backing the compliance models.

The limitation: while SaifrScan monitors published content, its post-publication surveillance is typically periodic instead of continuous and is not designed for real-time detection of adviser-initiated changes across distributed personal websites and social profiles. Saifr also lacks dedicated CCO expert support, meaning firms interpret complex edge cases without access to former regulators and compliance professionals.

Red Oak

Red Oak is an advertising review and compliance workflow system built for broker-dealers, RIAs, asset managers, and insurance firms with SEC 17a-4 compliant record keeping.

What They Offer

- Advertising review workflow engine with role-based permissions, approval routing, and audit trails for SEC and FINRA compliance

- Disclosure management automation, regulatory reporting, and document archiving compliant with SEC Rule 17a-4 record keeping requirements

- Integration with content distribution tools (acquired 4U) for pre-approved marketing content libraries that advisers can access and share

Red Oak works for broker-dealers with legacy compliance processes that focus on rigid workflow structure and detailed audit trails over user experience and content velocity.

The limitation: built as a document-centric compliance vault with static review rules instead of intelligent AI risk detection. Red Oak lacks automated content analysis, real-time risk scoring, and adaptive learning capabilities. The interface is designed for compliance teams instead of marketers, resulting in low adoption and teams continuing to operate outside the system via email and spreadsheets.

Why Luthor Is the Best Marketing Approval Workflow Software for Broker-Dealers

FINRA advertising regulations require broker-dealers to maintain principal review of retail communications and preserve approval records. Most compliance software documents approvals but doesn't prevent violations.

Luthor catches violations before publication. The AI engine identifies prohibited claims, missing disclosures, and non-compliant language across all content types including video and audio. When complex questions arise, you escalate directly to former regulators who understand broker-dealer compliance strategy.

Post-publication monitoring separates Luthor from alternatives. We scan adviser pages and social feeds continuously, flagging unapproved edits automatically.

Specialized AI models, real-time oversight, and expert escalation paths deliver faster approvals with lower risk than workflow-only tools.

FAQs

Can marketing approval software monitor content after it's published?

Luthor is one of the few platforms built especially for continuous post-publication monitoring of live adviser pages and social feeds, automatically flagging unapproved edits after content goes live. Some solutions focus on pre-publication review and may offer post-publication monitoring in periodic scans or limited channel coverage, meaning content can drift out of compliance between reviews without timely detection.

What's the difference between workflow software and compliance review platforms?

Workflow software routes content through approval steps and documents decisions. Compliance review platforms like Luthor and Saifr add AI detection that flags FINRA 2210 violations, missing disclosures, and prohibited claims before human reviewers see the content, reducing review time and error rates.

Do I need separate tools for different marketing channels?

No. Multi-channel platforms like Luthor handle web pages, emails, social posts, PDFs, video, and audio through one review process with consistent rules. Single-channel tools force you to manage separate workflows for each content type, creating gaps in coverage and inconsistent standards.

Final thoughts on marketing approval workflow solutions

FINRA 2210 approval demands more than routing content and storing files after the fact. Broker-dealers need systems that surface violations across web pages, social posts, email, and multimedia before content is published and continue watching for changes after it goes live. Luthor's marketing approval workflow software brings those capabilities together by combining AI-based screening, post-publication monitoring, exam-ready recordkeeping, and access to seasoned compliance professionals, giving firms a practical way to keep pace with adviser marketing while staying prepared for exams.