Best Compliance Platforms with Expert Support for Fintech Startups in December 2025

Compare fintech compliance platforms with expert support in December 2025. Review Luthor, Kadince, Saifr, Red Oak, and IntelligenceBank for SEC and FINRA marketing review.

Fintech startups face a harsh reality: compliance isn't optional, but hiring full-time compliance officers is not affordable. A seasoned Chief Compliance Officer (CCO) salary typically ranges from $180K-$300k on average, which is the kind of budget most early-stage companies need for product development or growth. Yet every email, landing page, and advisor communication you publish carries regulatory risk. One unapproved performance claim or missing disclosure can trigger examiner scrutiny, which can derail fundraising. Startup compliance solutions that pair experienced regulatory professionals with automated tools let you get expert review and approval without the full-time salary, so you can launch campaigns confidently while staying within budget.

TLDR:

- Fintech startups need compliance expertise but can't afford CCO salaries

- Most tools offer workflow or AI scanning, but lack access to regulatory experts

- Luthor pairs AI-powered content review with fractional CCO support from former regulators

- Luthor scans marketing materials and provides expert interpretation for edge cases

- Firms get automated detection, human judgment, and exam-ready documentation in one service

Why Fintech Startups Need Compliance Expert Support

Fintech startups face an uncomfortable reality: nearly 73% fail within three years, with regulatory and compliance challenges driving many of those failures. Marketing a financial product or service means thinking about SEC advertising rules, FINRA communications standards, and state-level regulations before your first campaign goes live.

Most early-stage fintech companies cannot afford a full-time chief compliance officer. A seasoned CCO commands $180,000 to $300,000 annually, plus benefits. That's a budget that could fund product development, customer acquisition, or additional engineering resources.

Yet compliance isn't optional. Every email campaign, landing page, social post, and advisor communication carries regulatory risk. A single unapproved performance claim or missing disclosure can trigger examiner scrutiny, fines, or reputational damage that derails fundraising and growth.

This resource gap creates the need for fractional CCO services and outsourced compliance officer models. You gain experienced regulatory judgment without the full-time salary, paired with tools that automate routine review work, allowing experts to focus on high-stakes decisions.

What Outsourced Compliance Officers Provide

Outsourced compliance officers handle three core tasks: reviewing marketing materials, monitoring regulatory changes, and building documentation for regulatory exams. You work with former regulators and experienced CCOs who look at content against SEC and FINRA requirements without joining your payroll.

The delivery model combines software with expert judgment. Automated tools scan content for missing disclosures, prohibited claims, or unapproved testimonials. When software flags an issue or hits a gray area, a compliance expert interprets the rule, reviews context, and recommends next steps.

Services typically include marketing review and approval, policy development, exam preparation, and monitoring of published content. You submit campaigns through a review queue, receive feedback with rule citations and suggested edits, and get approval before publication. The system archives every version and decision for regulatory audits.

Fractional arrangements let you scale support to match activity. A fintech launching its first advisor program might need weekly reviews and policy setup. A growth-stage firm running constant campaigns might need daily approvals and continuous monitoring. You pay for the capacity you use instead of carrying a fixed headcount.

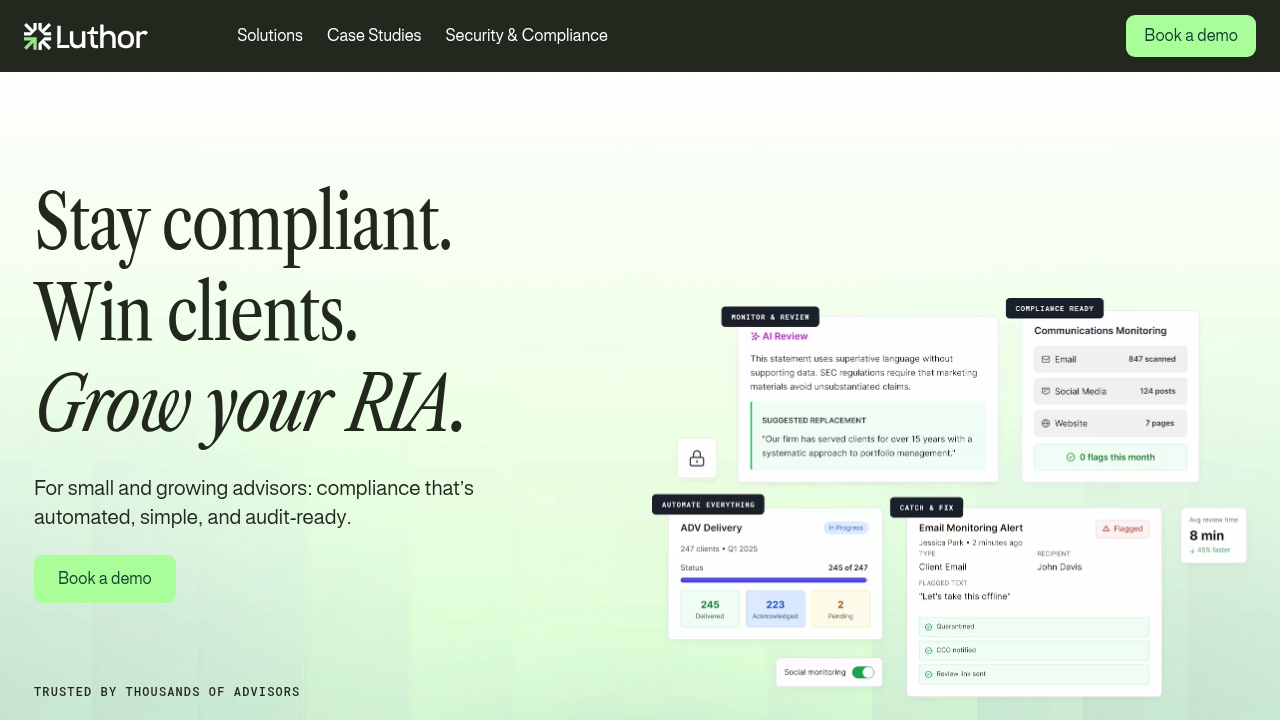

Luthor AI Marketing Review with Expert Support

Luthor solves a gap other tools miss: automated detection still requires regulatory expertise that most startups lack. The service combines AI content scanning with direct access to former regulators and CCOs who interpret edge cases and approve high-risk campaigns.

The AI engine scans marketing materials against SEC and FINRA advertising rules, identifying performance claims, testimonials, guarantees, and incomplete disclosures. Flagged content routes to experienced compliance professionals who provide specific guidance on required changes and regulatory reasoning.

The system processes video transcripts, audio recordings, and multi-language marketing materials through a single rule engine. Each submission receives automated risk scoring, as well as human review when campaigns require regulatory interpretation.

Kadince Marketing Compliance

Kadince serves banks and credit unions with workflow management for marketing approvals and community involvement tracking. The system routes ad submissions through approval chains and archives decisions for examiner requests.

Marketing teams submit content through a single interface versus email threads. Approvers view pending items in a queue, add comments, request changes, or mark materials as approved, including timestamps for regulatory documentation.

Kadince handles process orchestration but doesn't analyze content. Reviewers read every word manually, which works for institutions with light marketing volume but creates bottlenecks when campaign output increases.

The service doesn't include access to compliance experts. You're responsible for knowing the rules, interpreting gray areas, and making approval decisions. If your team lacks deep SEC or FINRA marketing expertise, Kadince won't fill that gap.

IntelligenceBank Compliance Operations

IntelligenceBank is a digital asset management system designed for enterprise marketing teams, featuring compliance workflows that build upon brand management capabilities. The service handles version control, approval routing, and asset distribution across marketing departments.

The acquisition of Red Marker introduced AI scanning, which flags potentially problematic language in financial marketing content. The AI checks for regulatory terms and phrases that might trigger review, though the engine wasn't purpose-built for SEC or FINRA advertising rules.

Setup requires extensive configuration. You map approval hierarchies, define custom fields, build review checklists, and train the system on your firm's terminology and risk tolerance. Implementation cycles often stretch weeks or months for complex organizations.

IntelligenceBank sells software, not compliance services. There's no fractional CCO support, no access to regulatory experts for interpreting edge cases, and no human backup when the AI encounters more complex advertising questions. Your internal team bears full responsibility for compliance determinations and understanding how rules apply to specific content.

Saifr Marketing Review

Saifr scans marketing content for regulatory violations across text, images, and video using AI models trained on financial services and insurance advertising rules. The tool flags problematic performance claims, missing disclosures, and unapproved testimonials before materials go live.

The software analyzes content and surfaces risk, but stops there. You get detection, not interpretation. When Saifr draws attention to a potential issue, your team determines whether it constitutes a true violation and what changes are necessary to satisfy regulatory requirements.

There's no fractional CCO support or access to compliance experts. If your fintech lacks in-house regulatory expertise, you're left reading guidance documents and making approval decisions without experienced backup when gray areas arise.

Red Oak Advertising Review Software

Red Oak serves over 1,800 financial firms with workflow automation for compliance approvals. The software routes marketing submissions through approval queues, tracks disclosure requirements, and maintains books and records documentation for regulatory exams.

Reviewers manually look at each piece against SEC and FINRA rules. Red Oak recently introduced an AI Review module that leverages Large Language Models (LLMs) to flag potential issues. However, this is a tool for your team to use. There is no fractional CCO support or access to compliance experts to interpret those AI findings for you. Your team remains responsible for training the prompts and making the final judgment calls.

AI Compliance Scanning Capabilities

Most compliance tools either provide no AI scanning or use general-purpose LLMs that weren't trained on financial advertising regulations. Kadince and Red Oak handle workflow but require manual review of every submission. IntelligenceBank's Red Marker module flags general regulatory terms, but wasn't built for SEC Marketing Rule or FINRA Rule 2210 requirements.

Saifr provides AI scanning trained on financial services advertising, identifying violations across text, images, and video. The system catches performance claims and missing disclosures, but doesn't include human expert review for edge cases.

Luthor's AI was trained using proprietary datasets annotated by compliance professionals who labeled thousands of real marketing examples. This training approach reduces false positives and improves the detection of more complex violations like implied guarantees or incomplete performance disclosures.

Workflow and Approval Process Management

Red Oak and Kadince track submissions, but need upfront routing configuration. You set permissions, map content types to reviewers, and build approval chains before launching. Both archive decisions with timestamps for exam documentation.

IntelligenceBank runs workflow inside its digital asset management system, adding friction if your marketing team doesn't already use their DAM. Teams must upload assets, apply tags, and move through approval hierarchies in that environment instead of their usual workspace.

Saifr scans content and flags issues, but offers minimal workflow management. There's no built-in approval routing or collaboration layer for marketers and reviewers to discuss flagged items.

Luthor pulls content directly from your CMS, email tools, or shared drives without manual uploads. Marketing teams see feedback where they're already working, and approvals happen in one click.

Every edit, comment, approval, and publication event is captured in audit-ready records that meet SEC and FINRA retention requirements. When examiners request documentation, you export complete review histories showing who approved content, when decisions were made, and what reasoning supported each approval.

Expert Support and Consultation Access

Red Oak, Kadince, IntelligenceBank, and Saifr offer software tools. When your marketing team faces a gray area, you're left to interpret SEC guidance, determine whether a claim violates FINRA standards, or assess if a testimonial meets safe harbor requirements on your own.

That gap creates risk for fintech startups. Your team understands product positioning and growth tactics, not the details of hypothetical performance disclosures or when advisor communications cross into retail advertising territory.

Luthor pairs software with fractional CCO support. You work directly with former regulators and chief compliance officers who review flagged content, interpret ambiguous rules, and approve high-risk campaigns. When the AI detects a potential issue, an expert looks at the context and provides specific guidance on required changes and the regulatory reasoning behind them.

You also receive exam preparation support. Compliance professionals review your marketing footprint, identify documentation gaps examiners might question, and help build defensible policies before regulatory visits. Software-only vendors don't offer this advisory layer.

Feature Comparison Table

| Feature | Luthor | Red Oak | Saifr | Kadince | IntelligenceBank |

|---|---|---|---|---|---|

| Core Strength | AI + Human Expert Review | Workflow & Archiving | AI Scanning (Contextual) | Community & Workflow | Brand Compliance & DAM |

| AI Capabilities | GenAI (LLM) trained on SEC/FINRA rules | AI Review Module (LLM) + Lexicon | GenAI (LLM) for detecting risks | None (Manual Review) | Rule-based scanning (via Red Marker) |

| Human Support | Fractional CCO / Expert Guidance | Software Support Only | Software Support Only | Software Support Only | Software Support Only |

| Setup & Config | Low (Pre-trained models) | High (Manual rule setup) | Medium (Model tuning) | Medium (Workflow setup) | High (Custom rule logic) |

Why Luthor is the Better Choice

Luthor combines AI scanning with fractional CCO support in one service. You get workflow automation and compliance consultants who interpret flagged content without contracting with multiple vendors.

The AI detects violations that other tools miss because it was trained on proprietary datasets created by compliance professionals. When edge cases arise, you work directly with former regulators who provide specific guidance and approval authority.

You get automated detection, expert judgment, exam preparation, and audit-ready documentation without enterprise headcount or budget.

Final thoughts on regulatory support for growing fintechs

You can't afford a full-time CCO, but you also can't afford to guess on regulatory questions. Fintech compliance services that pair AI scanning with access to former regulators give you both automated detection and expert interpretation when edge cases appear. Your marketing team gets clear guidance on required changes, and you build audit-ready documentation for regulatory exams. The right support protects your startup without draining the budget you need for product development and customer acquisition.

FAQ

What is a fractional CCO, and how does it differ from hiring a full-time compliance officer?

A fractional CCO provides experienced chief compliance officer services on a part-time or as-needed basis, typically costing far less than the $180,000-$300,000 annual salary of a full-time CCO. You get access to former regulators and seasoned compliance professionals who review your marketing materials, interpret SEC and FINRA rules, and prepare you for exams without the fixed overhead of a full-time hire.

How do AI compliance tools handle video and audio marketing content?

Advanced AI compliance platforms can process video transcripts and audio recordings to scan for regulatory violations, such as performance claims, testimonials, and missing disclosures. The AI analyzes spoken content against SEC and FINRA advertising rules the same way it reviews text-based materials, flagging issues before content goes live.

When should a fintech startup invest in outsourced compliance support?

You should consider outsourced compliance support before launching your first marketing campaign if you lack in-house regulatory expertise. A single unapproved performance claim or missing disclosure can trigger examiner scrutiny and fines that derail fundraising and growth, making early compliance investment far less expensive than fixing violations after publication.

What's the difference between compliance workflow software and platforms with expert support?

Compliance workflow software routes submissions through approval queues and archives decisions; however, your team must independently interpret all regulatory rules and make approval decisions. Platforms with expert support pair automated scanning with direct access to former regulators and CCOs who interpret gray areas, review flagged content, and provide specific guidance on required changes.

Can compliance platforms integrate with existing marketing tools like CMS and email systems?

Modern compliance platforms can pull content directly from your CMS, email tools, and shared drives without requiring manual uploads or switching between systems. Marketing teams receive feedback where they already work, and the tool captures every edit, comment, and approval in audit-ready records that meet SEC and FINRA retention requirements.