Top Content Approval Tools That Speed Up Financial Marketing in November 2025

Compare the best content approval tools for financial marketing teams in November 2025. Cut review times from weeks to days with AI-powered compliance solutions.

Every financial marketer knows the frustration all too well: you finish a campaign, send it to compliance, and then you wait. And wait. Marketing bottlenecks like these slow down your entire team. That bottleneck costs more than time; it costs momentum.

With the right tools, however, approval times can shrink from weeks to days. These solutions expedite content approvals between marketing teams and compliance officers. For firms in wealth management, advisory, and fintech, faster approvals mean more agile marketing without sacrificing regulatory safety.

In this article, we review the top content-approval acceleration tools for financial marketers in November 2025.

TLDR:

-

AI-powered tools cut financial marketing approval times from weeks to days (or faster)

-

Luthor accelerates content reviews up to 7× faster, increasing output from 6 to 45+ pieces monthly

-

Real-time monitoring across key digital channels catches SEC/FINRA violations before publication

-

Hybrid AI plus fractional CCO support delivers faster approvals than manual or software-only tools

-

Luthor combines automated compliance scanning with expert oversight for RIAs managing $5.7B+ in AUM

What Are Content Approval Acceleration Tools?

Content approval acceleration tools automate compliance review workflows for financial marketing materials. They replace manual email chains and spreadsheet tracking with automated routing, rule-based checks, and real-time collaboration between marketing teams and compliance officers.

These tools combine three core capabilities.

-

They scan content against regulatory requirements using AI engines trained on SEC and FINRA advertising rules.

-

They route materials through approval workflows automatically, alerting the right reviewers and tracking each stage.

-

They maintain audit trails of every revision and approval decision, creating the documentation regulators expect during examinations.

This category of tools exists because financial firms can't use generic project management or marketing automation tools for compliance-sensitive content. Securities regulations require specific oversight, record-keeping, and approval documentation that standard collaboration software wasn't built to handle.

How We Ranked Content Approval Acceleration Tools

We ranked tools based on what matters when compliance slows marketing output. Speed and accuracy of reviews top the list, but we also looked at how well each solution prevents delays before they happen.

Our key evaluation criteria include:

-

Real-time compliance monitoring across marketing channels (websites, social media, email, ads)

-

Automated workflow routing that removes manual handoffs and email chains

-

Integration of human compliance expertise alongside automated checks

-

Speed of approval cycles and documented acceleration vs. manual processes

-

Quality of audit trails and regulatory record-keeping

-

Multi-channel coverage and ability to monitor content wherever it's published

We weighted solutions that proactively flag issues during content creation versus simply archiving materials after publication. Tools that combine AI-powered rule engines with access to experienced compliance officers scored higher than software-only or service-only approaches.

These rankings are based on publicly available information regarding feature sets, competitive positioning, and client outcomes. We didn't conduct hands-on product testing, so our assessments are based on vendor documentation and industry positioning over direct experience with each tool's interface or performance.

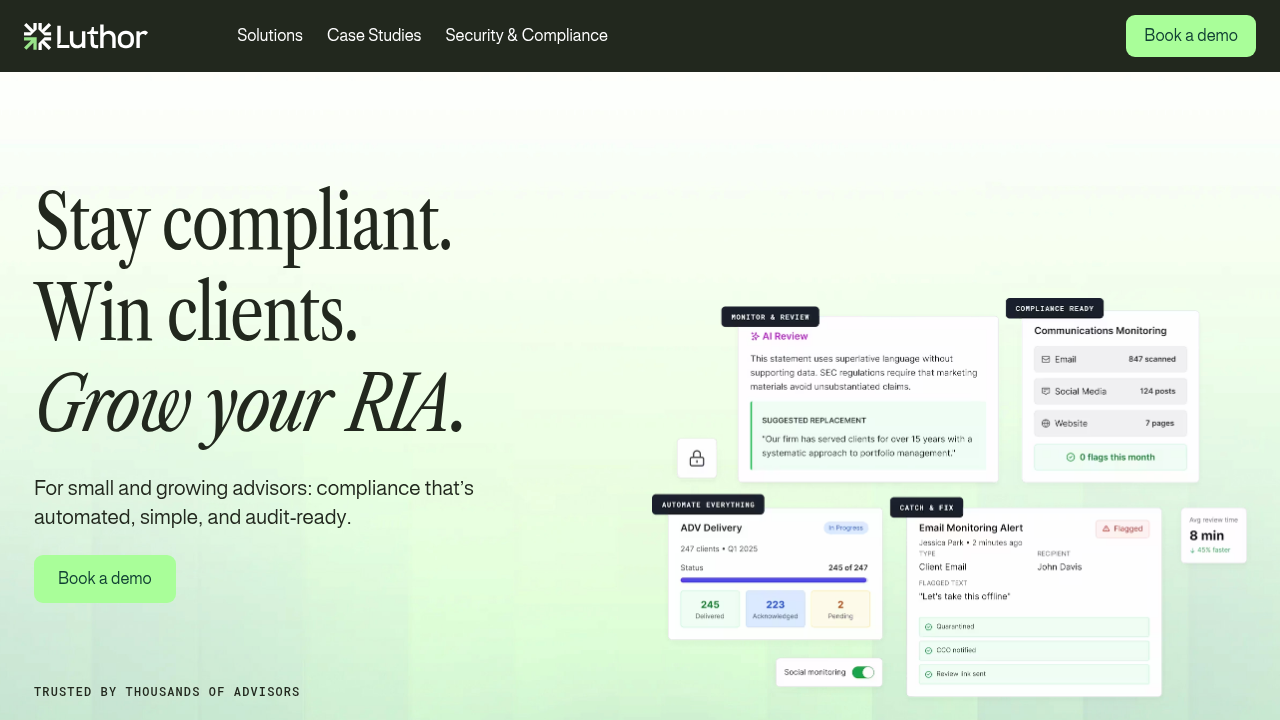

Best Overall Content Approval Acceleration Tool: Luthor

Luthor combines automated content scanning with on-demand access to experienced compliance officers. The workflow engine monitors content across websites, email campaigns, social media, and paid ads. When the AI flags a potential violation, you get instant alerts with recommended fixes based on SEC and FINRA rules.

Firms using Luthor publish 45+ marketing pieces monthly compared to 6 with manual reviews.

The fractional CCO team includes former regulators who review high-risk items and provide guidance on complex compliance questions. That expertise, combined with always-on monitoring and automated audit trails, keeps firms compliant without slowing down marketing velocity.

Form ADV updates, disclosure management, and compliance deadline tracking all run in the background while clients can focus on campaigns.

ACA Group

ACA Group provides scalable compliance, risk, and tech solutions for financial services firms, serving as a governance, risk, and compliance provider with its ComplianceAlpha technology.

What they offer

-

ComplianceAlpha regulatory technology for surveillance and monitoring

-

Advisory services from former SEC and FINRA regulators

-

Trade surveillance and market data analysis capabilities

-

Cybersecurity and technology risk assessment services

The user experience reveals limitations. Founded in 2002 by five former regulators, the system features an outdated interface design that requires 10-20 clicks for basic tasks. Marketing teams lose time working around complex menus when they need quick approvals.

ACA offers broad compliance coverage, but its legacy technology may slow daily operations.

SmartRIA

SmartRIA serves medium to enterprise RIAs with proactive compliance management software. The company has built its reputation around advisor-focused regulatory oversight.

What they offer

-

Advisor Alert tech for compliance monitoring

-

Automated onboarding and employee trade monitoring

-

Self-audit review checklists and compliance calendar templates

-

Custom professional services for unique compliance situations

SmartRIA only integrates with Wealthbox and Redtail CRMs, resulting in manual workarounds for content in email marketing systems, social media management tools, or content management systems. Marketing stacks that extend beyond those two CRMs require copying content between applications for compliance review.

RIA in a Box (COMPLY)

COMPLY provides compliance infrastructure for registered investment advisors. The system focuses on structured workflows and documentation management.

What they offer

-

Configurable compliance workflows adaptable to different firm structures

-

Document management with regulatory audit trail tracking

-

Regulatory filing support and compliance calendar systems

-

Educational training modules for compliance staff

The interface requires working with multiple screens and clicking through layered menus for routine approval tasks. Marketing teams waiting for content sign-offs may encounter friction when speed matters.

Feature Comparison Table of Content Approval Acceleration Tools

| Feature | Luthor | ACA Group | SmartRIA | COMPLY |

|---|---|---|---|---|

| Real-time Monitoring | ✅ Continuous across all channels | ✅ Trade surveillance focused | ❌ Limited monitoring | ❌ Manual review based |

| AI-powered Analysis | ✅ SEC/FINRA trained AI | ⚠️ Basic AI capabilities | ❌ No dedicated AI marketing review engine | ❌ No AI features |

| Multi-channel Coverage | ✅ All digital marketing channels | ⚠️ Limited to specific areas | ⚠️ RIA-focused only | ⚠️ Traditional channels only |

| Approval Speed | ✅ Up to 7× faster | ❌ Standard review cycles | ⚠️ Moderate acceleration | ❌ Manual pace |

| Expert Support | ✅ Fractional CCO access | ✅ Former regulator team | ⚠️ Consulting partnerships | ⚠️ Basic support |

| Integration Ease | ✅ Workflow integration | ❌ Complex implementation | ⚠️ Limited CRM integration | ❌ Minimal integration |

| User Interface | ✅ Intuitive design | ❌ Outdated, complex | ⚠️ Adequate usability | ❌ Legacy design |

Why Luthor Is the Best Content Approval Acceleration Tool

Financial marketing compliance grows more complex as regulatory scrutiny intensifies. The SEC and FINRA actively monitor digital content, making manual approval processes slow and risky.

Luthor's AI engine learns from evolving compliance requirements and adapts to new rules automatically. When regulations change, compliance checks update without manual reconfiguration.

The hybrid approach works because financial services marketing requires specialized oversight that generic collaboration tools can't provide. Luthor's fractional CCO team brings regulatory expertise that AI alone cannot replicate, while automation handles repetitive scanning and routing work.

Financial firms managing $5.7 billion+ in AUM trust Luthor because speed and compliance work together. As marketing velocity becomes a competitive advantage, compliance infrastructure must accelerate campaigns, not block them.

Final thoughts on optimizing compliance workflows for marketing teams

Financial marketing moves faster when compliance keeps pace. Compliance workflow optimization tools replace email chains and manual tracking with automated routing and real-time collaboration, making processes more efficient. For best results, choose a solution that combines AI scanning with human expertise.

FAQ

How much faster can content approval acceleration tools make compliance reviews?

Modern tools can reduce approval cycles from weeks to days or hours, with some platforms delivering up to 7× faster reviews compared to manual processes. Financial firms have increased output from roughly six marketing pieces per month to 45+ while maintaining full compliance.

What's the difference between AI-only and hybrid compliance tools?

AI-only tools scan content against regulatory rules but lack human judgment for complex situations. Hybrid solutions combine automated scanning with access to experienced compliance officers (often former regulators) who can review complex cases and provide guidance on gray-area questions that algorithms can't resolve alone.

When should your firm consider switching from manual compliance reviews?

If your marketing team waits more than a week for content approvals, misses campaign deadlines due to compliance bottlenecks, or struggles to maintain audit trails across multiple channels, an approval acceleration tool will likely improve your workflow. Firms without dedicated compliance staff benefit most from automated oversight.

Can these tools monitor content across all your marketing channels?

The best tools monitor websites, email campaigns, social media posts, newsletters, and paid advertising from a single solution. However, some tools only integrate with specific CRMs or focus on limited channels, requiring manual workarounds for content published elsewhere. Always check integration capabilities before selecting a tool.