Best AI-Powered Disclosure Management Tools for Financial Advisers (December 2025)

Compare the best AI disclosure management tools for financial advisers in December 2025. Review features, pricing, and SEC/FINRA compliance capabilities.

Missing a disclosure on a single social post can lead to an exam finding, and that risk grows as advisory firms publish across more channels with faster turnaround times. Disclosure requirements tied to performance claims, testimonials, and investment commentary are difficult to track manually, and spreadsheets break down once content volume increases. As a result, many firms are turning to specialized AI disclosure management software to review marketing content before and after publication, but not all tools deliver the same level of accuracy, channel coverage, or ongoing oversight.

TLDR:

- AI-powered disclosure tools attempt to identify potential SEC and FINRA disclosure gaps in marketing content before publication.

- Manual reviews miss disclosure gaps that regulators flag during exams.

- Some advanced tools verify disclosures across websites, email, social media, video, and audio in real time.

- Leading adviser-focused compliance systems combine AI detection, live monitoring, exam-ready archiving, and access to experienced CCOs.

- Automated disclosure management reduces approval delays while creating consistent, audit-ready records across all marketing channels.

What Is Disclosure Management for Financial Advisers?

Disclosure management tracks and verifies required disclosures across adviser marketing materials and client communications. Every piece of content needs specific regulatory disclosures when making performance claims, showing testimonials, or discussing investment strategies.

SEC Marketing Rule requirements for investment advisers and FINRA Rule 2210 standards for broker-dealers require clear disclosures that explain risks, limitations, and material facts. Advertising deficiencies, including incomplete or missing disclosures, are frequently cited during SEC and FINRA exams. A single social post without proper context can trigger regulatory scrutiny.

The challenge grows with scale. Advisers producing frequent content across multiple channels face hundreds of disclosure requirements. Performance advertising requires specific calculation methodologies, time period disclosures, and additional contextual information such as fee treatment and comparability, depending on the claim. Testimonials require relationship and compensation disclosures. Hypothetical returns demand assumption disclosures.

Manual disclosure management means spreadsheets, style guides, and line-by-line reviews. Advisers often delay campaigns waiting for compliance sign-off, or publish content with missing disclosures and look into the gap during an exam.

AI-powered disclosure management tools automate this verification. They scan content, identify disclosure triggers, flag missing language, and suggest compliant alternatives.

How We Ranked AI-Powered Disclosure Management Tools

We tested disclosure management tools against a set of criteria that matter for regulatory compliance.

AI accuracy measures how reliably a tool spots disclosure triggers in marketing content. Top systems catch performance claims, testimonials, endorsements, and guarantees with few false positives. Instead of relying solely on keywords, they also take context into account.

Automated rule checking tests how well tools apply SEC Marketing Rule and FINRA Rule 2210 standards. This includes verifying required disclosures are present, correctly worded, and properly placed.

Workflow speed tracks approval routing, revision history, and turnaround time. Tools that cut review cycles from days to hours save marketing teams real time.

Archiving capabilities determine audit readiness. Systems must keep tamper-proof records of every review, approval, and content version that meet SEC and FINRA retention rules.

Multi-channel coverage matters because advisers publish across websites, email, and social media. Tools should handle all formats without separate reviews for each channel.

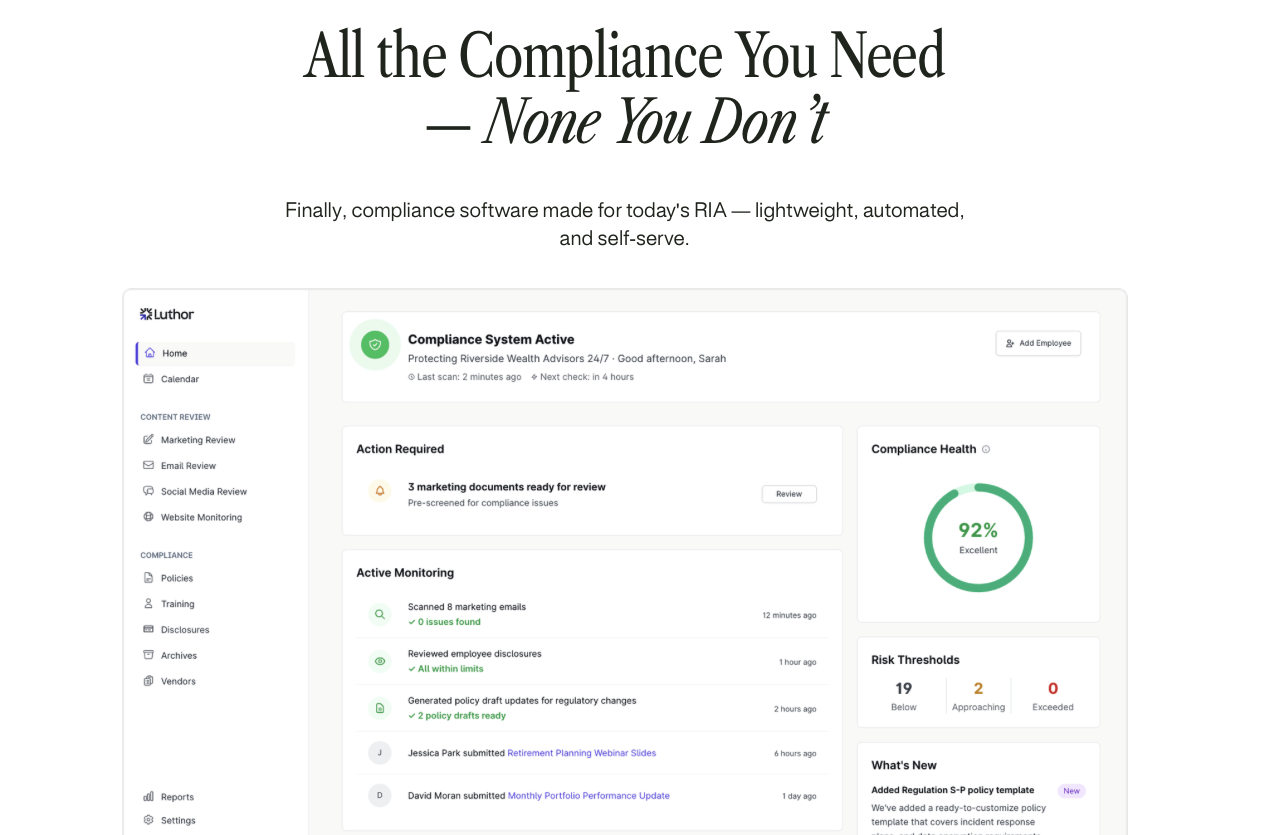

Luthor

We built Luthor to automate disclosure verification across every marketing channel advisers use. Our AI review engine scans content before publication, identifies missing disclosures, and suggests compliant language in real time across websites, emails, social media, video, and audio.

What Luthor Offers

- AI engine trained on SEC Marketing Rule and FINRA 2210 that flags performance claims, testimonials, guarantees, and disclosure gaps before human review

- Automated disclosure detection that identifies required disclosures by content type and suggests firm-approved templates

- Real-time monitoring of live sites and adviser pages that catches unapproved edits

- Exam-ready archiving with tamper-proof storage that captures every version, approval, and edit

- Multi-channel coverage with consistent rule enforcement across all digital marketing

Our AI models are informed by proprietary datasets and compliance expertise developed in collaboration with experienced compliance professionals. We support video, audio, and multi-language content, including workflows for analyzing content beyond standard text-based review.

Kadince

Kadince is a marketing compliance and workflow tool built for community banks and credit unions to track marketing approvals and maintain audit-ready documentation.

What They Offer

- Marketing project tracking system that sends automated approval notifications and sequences projects through compliance workflows

- Digital archiving that replaces three-ring binders with searchable cloud storage for exam preparation

- CRA management and community involvement tracking alongside marketing compliance

Kadince works well for community banks and credit unions with basic marketing approval needs who want to organize projects and prepare for audits without AI analysis.

The system relies primarily on manual review workflows and does not offer advanced AI-driven detection of disclosure violations or performance claims. Reviewers must manually identify all regulatory problems. Supports uploading videos and audio files for compliance review workflows, but relies primarily on manual review processes and does not provide native real-time website monitoring.

IntelligenceBank

IntelligenceBank is a digital asset management and marketing operations solution that includes compliance workflow capabilities as part of a broader brand management system.

What They Offer

- Digital asset management with approval workflows, version control, and metadata tagging for organizing marketing content libraries

- Brand portal and guidelines management to enforce visual brand standards across teams and external agencies

- AI compliance scanning that flags trigger words and suggests disclosures within web content using customizable rule libraries

IntelligenceBank works for large enterprises managing complex brand asset libraries across multiple markets who need DAM capabilities combined with basic compliance review features.

The system is built primarily as a DAM solution instead of financial services compliance software. It is not purpose-built around SEC Marketing Rule and FINRA 2210 requirements and typically requires customization to align with adviser-specific disclosure standards. Compliance features are generic across industries instead of trained on financial advertising regulations. No expert human review or fractional CCO support for complex financial marketing decisions.

IntelligenceBank serves organizations focusing on asset management over specialized compliance. Financial advisers requiring accurate SEC and FINRA rule detection will benefit from purpose-built financial services compliance engines.

Saifr

Saifr is a financial compliance tech provider incubated by Fidelity Investments that offers AI-powered marketing review tools for detecting regulatory risks in communications.

What They Offer

- AI models trained on financial advertising rules that detect promissory language, performance claims, testimonials, and misleading statements

- SaifrReview workflow tool for in-line collaboration between marketing and compliance teams with risk scoring and approval tracking

- SaifrScan API for integrating compliance checks into existing document workflows and content management systems

Saifr works well for large financial institutions with existing enterprise systems looking for API-based compliance scanning to embed into current workflow infrastructure.

The limitation is its focus on pre-publication scanning instead of continuous monitoring of live content, as it does not natively offer real-time website monitoring to detect post-publication content changes. Does not provide native, end-to-end WORM-style archiving for exam-ready record keeping without relying on additional third-party systems.

Red Oak Compliance Solutions

Red Oak is a compliance software provider for RIAs and broker-dealers offering advertising review, disclosure management, and registration tracking tools.

What They Offer

- Advertising review software with configurable workflows, lexicon scanning for problematic phrases, and routing through compliance approval chains

- Disclosure Intelligence module that scans documents to apply proper disclosures based on firm-specific rules

- AI Review module (beta) that detects potentially non-compliant language and provides real-time feedback to submitters before formal review

Red Oak serves RIAs and broker-dealers seeking a compliance suite that includes registration management, complaint tracking, and licensing alongside advertising review.

The limitation is that AI capabilities remain in beta and are not fully integrated. Core functionality relies on manual lexicon configuration and rule building. Red Oak does not provide expert human review or fractional CCO support. Implementation can take several weeks.

Red Oak works for firms wanting an all-in-one compliance suite, but advisers focusing on advanced AI accuracy and integrated expert support will find specialized marketing review engines deliver faster approvals.

Why Luthor Is the Best AI-Powered Disclosure Management Tool for Financial Advisers

Existing tools cover specific pieces of the disclosure workflow without tackling the full compliance picture. Workflow systems organize approvals but lack AI-powered content analysis. Asset management solutions apply broad compliance rules that miss financial services nuances. API tools require separate archiving. Suite providers offer wide feature sets without specialized AI or expert access.

Luthor combines AI detection, monitoring, archiving, and expert support in one system. Our models train especially on SEC and FINRA advertising rules to identify disclosure gaps with fewer false positives. Real-time monitoring tracks content changes after publication. Exam-ready archiving captures approval decisions. Compliance experts review complex campaigns.

Manual review misses disclosures that regulators flag during exams. Automated checks handle repetitive content scanning so compliance teams review judgment-based decisions instead of reading every line. Teams publish more campaigns while meeting regulatory standards and maintaining audit documentation.

FAQs

Which disclosure management tool is best for small RIAs with limited compliance staff?

Luthor works best for small to mid-sized RIAs because it combines AI-powered disclosure detection with access to compliance experts, eliminating the need for large in-house teams.

How do I choose between a specialized disclosure tool and a full compliance suite?

Choose a specialized tool like Luthor or Saifr if your primary need is fast, accurate marketing review with AI-powered disclosure detection. Pick a full suite like Red Oak if you need registration tracking, complaint management, and licensing alongside advertising review.

Can disclosure management tools review video and audio content?

Many tools offer limited or no support for reviewing video or audio content, often relying primarily on text-based analysis. Luthor handles video, audio, and multi-language analysis, while Kadince, IntelligenceBank, Saifr, and Red Oak focus only on text-based materials.

Final thoughts on automated disclosure verification

Manual reviews leave room for missed disclosures, especially as content volume and channel mix expand. AI disclosure tools surface performance claims, testimonials, and missing language before issues reach regulators, while also creating records examiners expect to see. Solutions like Luthor disclosure management software combine automated checks with ongoing oversight, helping teams publish confidently across social, email, and web, starting where disclosure gaps appear most often and compound the fastest.